THEPALMER

FLEETCOR (NYSE:FLT) is a enterprise funds firm that makes a speciality of gas playing cards and automatic enterprise funds, for fleets of vans and vans internationally. The Fintech Expense administration trade is forecasted to develop at an 11.2% compounded annual progress charge and attain a worth of $6.6 billion by 2028.

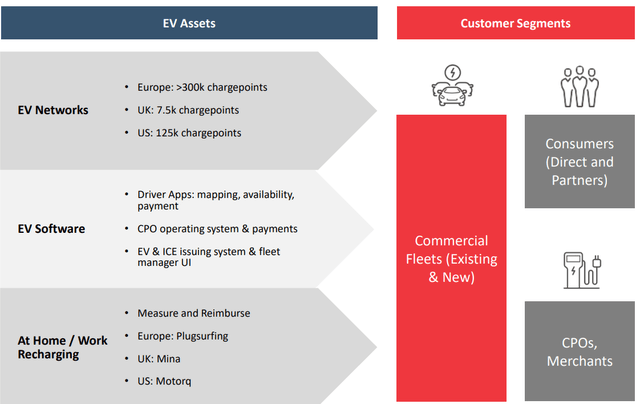

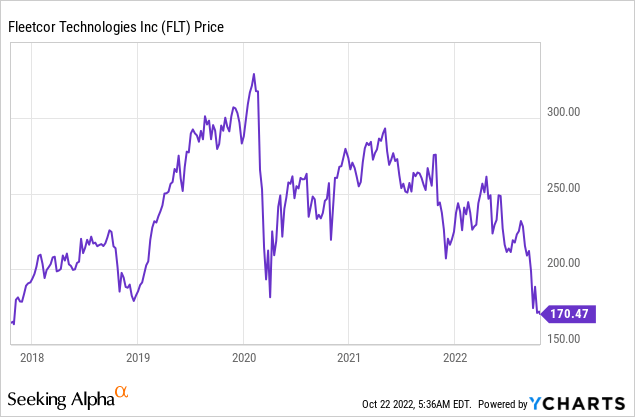

The corporate has not too long ago introduced the acquisition of EV charging level supplier Plugsurfing which owns 300,000 charging factors throughout Europe. In accordance with the enterprise press launch that is “almost 80% of all cost factors in Europe” which appears unbelievable at first look. However even when the corporate means 80% protection of Europe, that is nonetheless a robust worth proposition, given the expansion within the EV trade which I’ll share additional particulars on later on this publish. The corporate’s inventory worth has slid down by 48% from its all-time highs in early 2020 and trades decrease than the pandemic crash low. Thus on this publish, I’ll break down the corporate’s enterprise mannequin, financials, and valuation, let’s dive in.

Fintech Enterprise Mannequin

FLEETCOR was based within the 12 months 2000 and began as a fleet card supplier for enterprise fleets. Fleet playing cards or “gas playing cards” are fee playing cards utilized by companies to handle driver gas and upkeep prices whereas on the street. These playing cards allow correct reporting of mileage bills, mounted gas costs which do not change by area and straightforward reporting. In 2010 FLEETCOR expanded its enterprise to cowl vendor fee applications and added additional worker expense classes. Then in 2020, the corporate expanded additional to turn out to be a complete company funds resolution supplier. This platform affords expense administration, scheduled vendor funds, compliance and even integrates with in style accounting software program.

FLEETCOR (Investor Presentation)

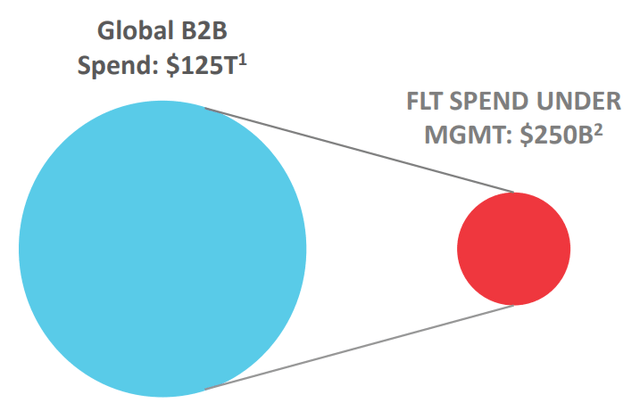

FLEETCOR estimates it has main market positions within the Fleet “Expense Administration” and Vendor funds classes. The enterprise has roughly $250 billion of spend below administration vs the worldwide B2B spend of $125 trillion.

FLEETCOR TAM (Investor Presentation)

Regardless of being based over 20 years in the past, the corporate is frequently innovating each with its platform and digital promoting. For instance, the corporate created a personality referred to as “Gasoline Card Barb” as a part of a humor-driven social media marketing campaign which has confirmed to be very profitable.

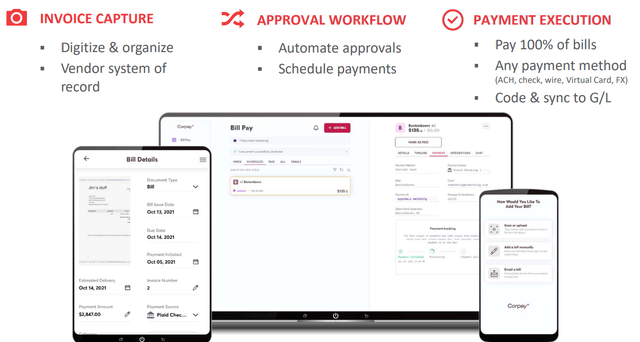

The corporate has additionally introduced a brand new accounts payables model referred to as “Corpay”. It is a platform that helps companies automate accounts payable and do cost-effective cross-border transactions whereas lowering fraud danger. The model has positioned itself as “extra versatile than banks” but in addition “safer than Fintechs” which is a robust place I consider will resonate with companies.

FLEETCOR Tech (Investor Presentation)

EV Technique

Local weather change, client preferences, and authorities incentives are forecasted to trigger a wave within the adoption of electrical automobiles. The truth is, one examine signifies that the EV market was value $163 billion in 2020 and is forecasted to develop at a fast 18.2% CAGR to achieve $824 billion by the tip of the interval. FLEETCOR’s administration believes that regardless of the wave of progress, Electrical automobiles will solely make up an estimated 50% of automobiles on the street within the UK by 2030 and 20% of automobiles within the US. The corporate believes that companies could have a brand new problem of managing “blended fleets” and thus that’s the place they see a market alternative. The corporate already has expertise on this trade and has helped there conventional fleet prospects transition over to EVs. The truth is, the enterprise processed roughly 3 million EV transactions in Europe in 2020. Administration plans to additional assault this market with a three-pronged technique. The primary a part of that is constructing out “connectivity” to EV charging stations. A key a part of enabling this was the current acquisition of Plugsurfing. This firm has over 300,000 cost factors which is 80% of all EV charging stations in Europe, in accordance to the corporate.

The know-how additionally features a Plugsurfing App which gives tariff info and affords straightforward fee to be facilitated. The corporate additionally plans to additional combine with non-public charging factors and even companions with utility suppliers. An instance buyer is Virgin Media O2 which is among the largest telecommunications firms within the UK. This firm has built-in with All Star EV (which is a subsidiary of FLEETCOR) so as to supply EV charging factors on the properties of drivers for its 4,300 vans by 2030. Initially, the deal if for simply 300 vans however that is nonetheless an excellent begin and proves the idea.

Rising Financials

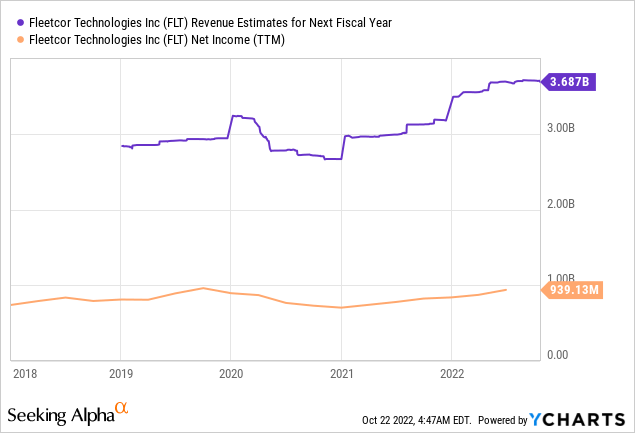

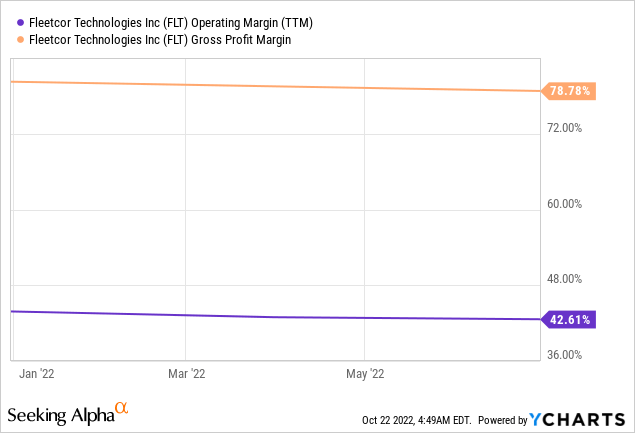

FLEETCOR generated strong monetary outcomes for the second quarter of 2022. Income was $861.3 million which elevated by a fast 29% 12 months over 12 months and beat analyst estimates by $40.3 million. On an natural foundation, the enterprise grew its income by 17% 12 months over 12 months, pushed by sturdy leads to company funds and Lodging. In October 2022, the corporate introduced the acquisition of Roomex a European Workforce lodging enterprise that has 600 enterprise prospects, who’ve stayed in roughly 50,000 inns. This acquisition enhances FLEETCOR’s present lodging enterprise and appears to be an excellent acquisition general, though the value paid is unknown.

Web earnings popped by a fast 34% to $262.2 million, up from $196.2 million within the equal quarter final 12 months. Earnings Per Share additionally elevated to $3.35 which beat analyst expectations by $0.35. Within the second quarter, Gasoline large BP North America prolonged its relationship and the corporate received one of many largest international meals chains as a buyer, for its present card program. Delta Airways additionally chosen the enterprise’s new “distressed passenger” cell app to automate passenger resort bookings within the occasion of a canceled flight. It is a recreation changer because it means there isn’t any want to attend round on the airport, you merely get an alert for the resort reserving. FLEETCOR has a brilliant excessive retention charge of 92% which suggests the shoppers are extraordinarily “sticky” and thus constant money movement is anticipated.

FLEETCOR has a strong steadiness sheet with $1.4 billion in money and short-term investments. The corporate does have a considerable amount of long-term debt ~$4.7 billion, however solely $508 million in present debt and thus that is manageable.

Superior Valuation

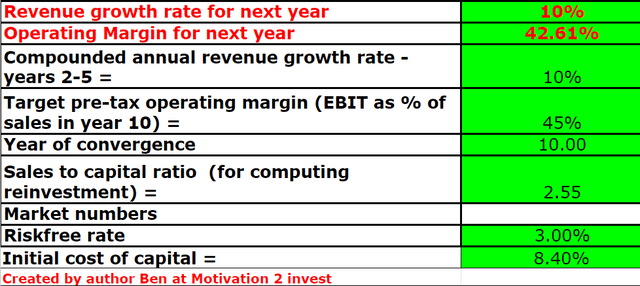

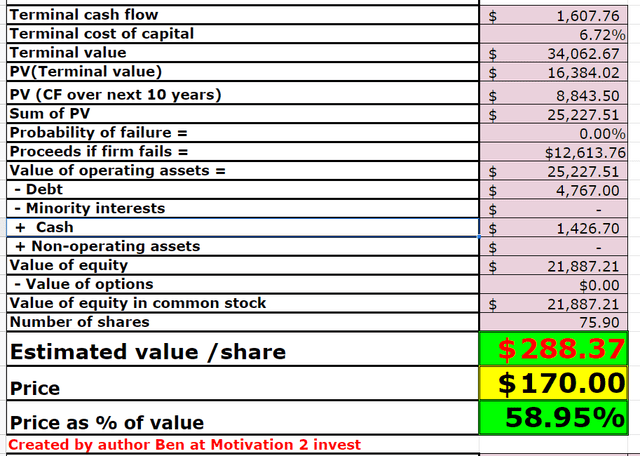

With a purpose to worth FLEETCOR I’ve plugged the most recent financials into my superior valuation mannequin which makes use of the discounted money movement technique of valuation. I’ve forecasted a conservative 10% income progress for subsequent 12 months and 10% over the subsequent 2 to five years.

FLEETCOR inventory valuation (created by writer Ben at Motivation 2 Make investments)

I’ve forecasted the enterprise to extend its margin barely to 45% over the subsequent 10 years as the corporate advantages from additional EV charging income.

FLEETCOR inventory valuation (created by writer Ben at Motivation 2 Make investments)

Given these components I get a good worth of $288 per share, the inventory is buying and selling at $170 per share on the time of writing and thus is over 40% undervalued.

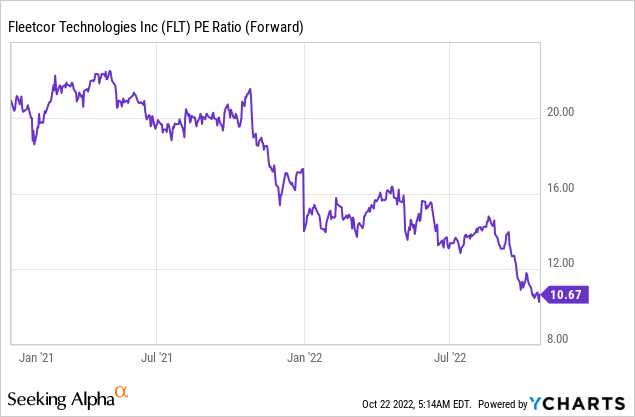

As an additional datapoint, FLEETCOR trades at a PE ratio = 10.67 which is 47% cheaper than its 5 12 months common.

Dangers

Competitors

There may be loads of competitors within the enterprise bills and automatic funds house. These firms embody SAP Concur software program, Sage Intacct, Payoneer, Invoice.com, Tradeshift, and plenty of extra. Within the gas card house, we’ve got firms comparable to FuelGenie and varied direct gas operator playing cards by way of Shell and BP. This implies the corporate does not actually have a “moat” across the enterprise which may very well be a difficulty.

Recession

The excessive inflation and rising rate of interest atmosphere is forecasted to trigger a recession and trigger decrease financial demand. This isn’t nice for any enterprise and should trigger demand for FLEETCOR’s prospects providers to slowdown additionally.

Remaining Ideas

FLEETCOR is a really intriguing firm that’s frequently innovating and buying companies throughout its trade. The enterprise gives a singular play on the fintech and EV charging trade. On the time of writing the enterprise is undervalued intrinsically and thus it appears to be like to be an excellent funding long run.