With its inventory down 14% over the previous month, it’s straightforward to ignore Tourmaline Oil (TSE:TOU). Nonetheless, a more in-depth have a look at its sound financials may trigger you to suppose once more. On condition that fundamentals normally drive long-term market outcomes, the corporate is price . On this article, we determined to deal with Tourmaline Oil’s ROE.

Return on fairness or ROE is a key measure used to evaluate how effectively an organization’s administration is using the corporate’s capital. In brief, ROE reveals the revenue every greenback generates with respect to its shareholder investments.

See our newest evaluation for Tourmaline Oil

How Do You Calculate Return On Fairness?

ROE will be calculated by utilizing the formulation:

Return on Fairness = Web Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, primarily based on the above formulation, the ROE for Tourmaline Oil is:

38% = CA$5.5b ÷ CA$15b (Based mostly on the trailing twelve months to September 2022).

The ‘return’ refers to an organization’s earnings during the last yr. That implies that for each CA$1 price of shareholders’ fairness, the corporate generated CA$0.38 in revenue.

What Is The Relationship Between ROE And Earnings Development?

We now have already established that ROE serves as an environment friendly profit-generating gauge for an organization’s future earnings. Relying on how a lot of those income the corporate reinvests or “retains”, and the way successfully it does so, we’re then capable of assess an organization’s earnings development potential. Assuming all else is equal, firms which have each a better return on fairness and better revenue retention are normally those which have a better development fee when in comparison with firms that do not have the identical options.

Tourmaline Oil’s Earnings Development And 38% ROE

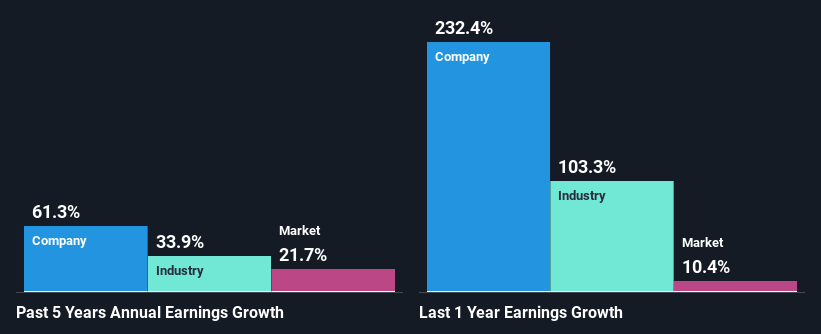

Very first thing first, we like that Tourmaline Oil has a powerful ROE. Secondly, even when in comparison with the trade common of 25% the corporate’s ROE is sort of spectacular. So, the substantial 61% web earnings development seen by Tourmaline Oil over the previous 5 years is not overly shocking.

We then in contrast Tourmaline Oil’s web earnings development with the trade and we’re happy to see that the corporate’s development determine is increased when put next with the trade which has a development fee of 34% in the identical interval.

Earnings development is a large consider inventory valuation. The investor ought to attempt to set up if the anticipated development or decline in earnings, whichever the case could also be, is priced in. By doing so, they are going to have an concept if the inventory is headed into clear blue waters or if swampy waters await. Has the market priced sooner or later outlook for TOU? Yow will discover out in our newest intrinsic worth infographic analysis report.

Is Tourmaline Oil Effectively Re-investing Its Earnings?

Tourmaline Oil’s ‘ three-year median payout ratio is on the decrease aspect at 17% implying that it’s retaining a better share (83%) of its income. So it looks as if the administration is reinvesting income closely to develop its enterprise and this displays in its earnings development quantity.

Furthermore, Tourmaline Oil is decided to maintain sharing its income with shareholders which we infer from its lengthy historical past of 5 years of paying a dividend. Current analyst estimates recommend that the corporate’s future payout ratio is predicted to drop to 13% over the following three years.

Abstract

In whole, we’re fairly proud of Tourmaline Oil’s efficiency. Notably, we like that the corporate is reinvesting closely into its enterprise, and at a excessive fee of return. Unsurprisingly, this has led to a powerful earnings development. With that mentioned, on finding out the newest analyst forecasts, we discovered that whereas the corporate has seen development in its previous earnings, analysts count on its future earnings to shrink. To know extra concerning the firm’s future earnings development forecasts check out this free report on analyst forecasts for the corporate to seek out out extra.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Tourmaline Oil is doubtlessly over or undervalued by trying out our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to convey you long-term targeted evaluation pushed by basic information. Be aware that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.