Michael Vi

Palantir Applied sciences Inc. (NYSE:PLTR) as soon as once more failed to fulfill third-quarter earnings expectations. Progress charges, significantly within the business enterprise, are approaching vital ranges, undermining your complete funding thesis for Palantir’s inventory.

The danger/reward ratio and Palantir’s valuation a number of are each out of whack, and the corporate continues to exhibit its lack of ability to generate any sort of profitability.

Since Palantir misplaced greater than $100 million within the third quarter and the outlook is bleak, I imagine PLTR will change into a penny inventory within the close to future.

A Double-Miss For The Third Quarter

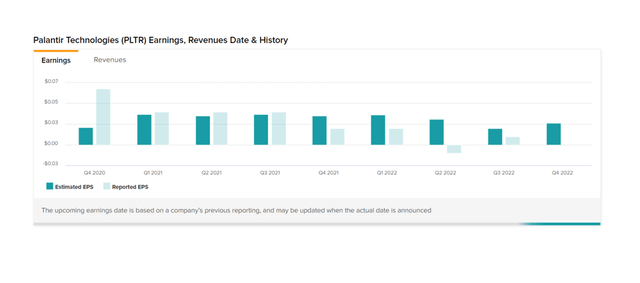

In case you are a Palantir investor, the earlier lesson was to not count on any earnings from the software program firm and to be disenchanted when it comes to earnings surprises. And Palantir did it once more within the third quarter.

The software program firm reported Q3’22 earnings of $0.01 per share. Earnings of $0.02 per share have been anticipated, representing a -50% earnings shock. Palantir delivered a unfavorable earnings shock for the fourth consecutive quarter.

Earnings And Revenues (Palantir Applied sciences Inc)

The Streak Of Thoughts-Blowing Losses Continues

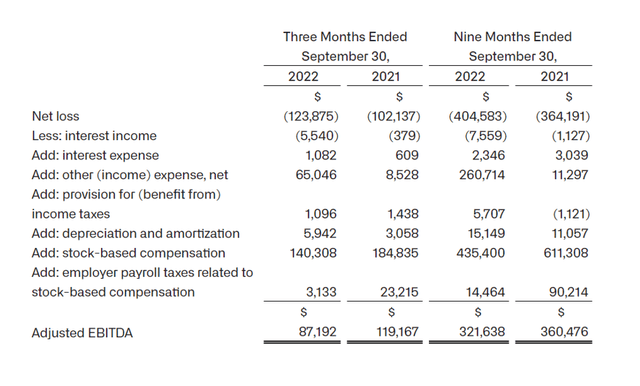

Sadly, Palantir generates earnings by deducting a slew of bills, most notably non-cash stock-based compensation (“SBC”) bills. These prices totaled $140.31 million in Q3’22 and $435.40 million within the 9 months ending September 30, 2022.

Palantir continued to incur internet losses of $123.88 million within the third quarter and $404.58 million within the 9 months ending September 30, 2022, owing to excessive SBC bills.

As proven within the chart under, Palantir’s year-to-date internet losses have been solely pushed by Palantir’s extremely preferential remedy of executives.

YTD Internet Losses (Palantir Applied sciences Inc)

Palantir’s YTD losses elevated the corporate’s gathered deficit to $5.89 billion as of September 30, 2022, indicating that an funding within the software program firm has confirmed to be extraordinarily dangerous to the corporate and its shareholders.

Regardless of working as a going concern for practically 20 years, the software program firm has but to determine even a fundamental stage of profitability.

Palantir Industrial: Slowdown

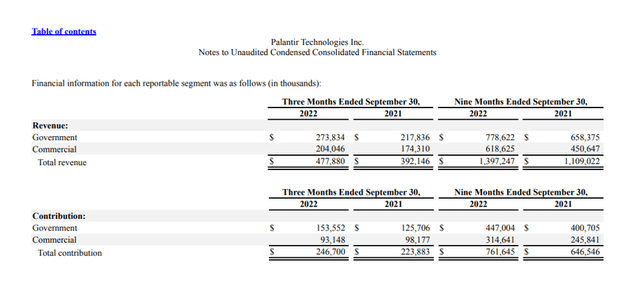

A lot of the optimism for the next valuation was primarily based on Palantir’s business success.

Palantir served authorities and company purchasers with its software program platforms and is paid a recurring stream of revenue because of this. Palantir generated business gross sales of $204.05 million in Q3’22, up from $174.31 million the earlier 12 months.

Palantir’s business gross sales elevated by solely 17% YoY, a big slowdown from the 46% development charge in Q2’22. Palantir’s authorities gross sales elevated by 26% YoY to $273.83 million from $217.84 million.

Authorities And Industrial Income (Palantir Applied sciences Inc)

Many analysts used Palantir’s business power as an excuse to suggest the corporate and argue for the next valuation, however the third quarter demonstrated that the software program firm cannot depend on business gross sales development.

Palantir’s business enterprise could change into a drag on general firm efficiency as corporations spend much less cash on software program.

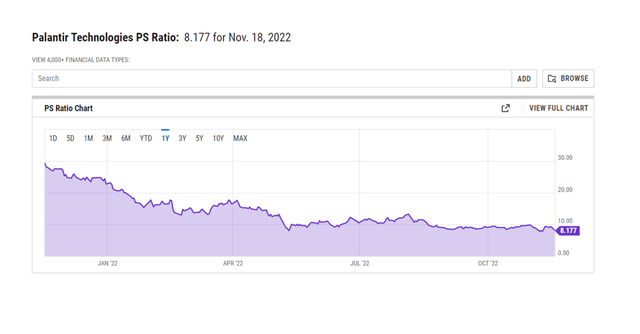

Inflated Gross sales A number of

It is a thriller to me how an organization like Palantir, which has demonstrated its lack of ability to generate even the smallest of internet earnings over the past 20 years, has persuaded traders to pay 8.2x gross sales. Nonetheless, it seems that there are a lot of traders prepared to pay such a excessive a number of.

Why Palantir May See A Decrease/Increased Valuation

Palantir, in my view, is unlikely to develop right into a considerably bigger valuation just because the corporate is struggling on so many fronts.

The corporate is unable to generate optimistic internet revenue, the business enterprise is struggling, and Palantir doubtless is not going to obtain its much-touted gross sales development of 30% this 12 months.

Palantir must engineer a turnaround in profitability and reignite development in its business enterprise to succeed in the next valuation.

My Conclusion

Do not be duped twice. Palantir already discredited its funding case in Q2’22 when it acknowledged that it might be unable to extend gross sales by 30% this 12 months, and now the business portion of Palantir’s enterprise, whose traction was hyped as an excuse for an inflation valuation, can also be inflicting concern.

Palantir’s business gross sales development slowed dramatically within the final quarter, and the corporate’s internet losses exceeded $100 million as soon as once more. Palantir solely achieves optimistic adjusted EBITDA profitability by deducting SBC bills, which is a damning indictment after 20 years in enterprise.

Palantir’s gross sales a number of, in my view, shouldn’t be sustainable given the corporate’s present deceleration. The inventory may very nicely be on its approach to changing into a penny inventory (commerce at $5 or much less) within the very close to future if Palantir doesn’t begin exhibiting earnings quickly.