hapabapa

Palantir Applied sciences (NYSE:PLTR) reported its Q3 earnings outcomes final week and so they have been near expectations. The corporate additionally offered encouraging indicators relating to future working momentum. Its shares stay undervalued and long-term traders ought to proceed to purchase.

As I’ve lined in earlier articles, I’m bullish on Palantir over the long run as I see the upside potential as fairly engaging, though in current quarters the corporate’s monetary efficiency has been delicate because of macroeconomic points that led to slower progress.

Nevertheless, if the corporate executes nicely on its progress technique, it’ll change into a a lot bigger firm over the subsequent few years, and is prone to attain operational break even by 2025, as I’ve analyzed in a current article. Whereas as an early progress firm Palantir’s funding case continues to be considerably speculative, it’s in the fitting path to change into a worthwhile firm over the medium time period.

Palantir’s Earnings Evaluation

Final week, Palantir has reported its most up-to-date quarterly earnings outcomes and so they have been largely consistent with expectations. Its quarterly income amounted to $477.9 million, whereas the road was anticipating $474.5 million and its steerage was $475 million, and its adjusted EPS was $0.01 (vs. $0.02 anticipated).

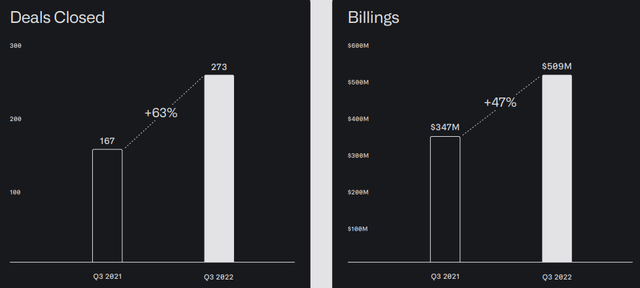

In Q3 2022, Palantir’s income grew by 22% YoY, a smaller progress price than achieved within the earlier quarter (+26% YoY), and in addition decrease than its annual goal of about +30%. Regardless of slower progress prior to now few quarters, the corporate has reached some vital milestones, specifically its authorities enterprise reached $1 billion in income on a trailing 12-month foundation and this was the very first time it had reached this determine. As well as, new offers and billings continued to extend at robust progress charges.

Offers and billings (Palantir)

Moreover, whereas income progress has slowed down, however its buyer rely continues to extend at a gradual tempo, reaching 337 on the finish of September, representing a rise of 66% YoY. Within the quarter, the corporate added 33 internet new clients (vs. 27 throughout Q2 2022), being a constructive signal that Palantir’s progress technique is progressing nicely, particularly relating to its industrial push, which is the phase that has been main income progress extra just lately.

Certainly, within the final quarter, Palantir’s U.S. industrial income elevated by 53% YoY to $88 million, whereas complete industrial income represented some 43% of complete income. That is supported by a rising variety of clients, which elevated to 132 simply within the U.S. on the finish of Q3 2022, up 124% YoY. However, U.S. authorities income elevated by 23% YoY, a a lot decrease progress price than in comparison with the industrial phase.

Concerning its internet greenback retention, it was 119% within the final quarter and unchanged from the earlier one, which is constructive as recurring clients proceed to extend engagement with the corporate, boding nicely for future income progress as the whole variety of clients will increase.

Moreover, in Q3 its complete remaining deal worth elevated by 14% YoY to $4.1 billion, a rise of $600 million in comparison with Q2 2022, which is one other constructive sign of stronger income progress within the close to future. Traders ought to observe that Palantir reported some softness on this metric throughout Q2 (up by solely 4% YoY to $3.5 billion), thus the rise reported in Q3 reveals that Palantir’s providing continues so as to add worth for its clients and they’re prepared to enter into medium to long run service commitments even throughout the present unsure macroeconomic setting.

Concerning Palantir’s profitability, the corporate continues to put money into enterprise progress and maintains its hiring plans, which hurts its short-term working margins, however help its long-term enterprise progress. Palantir continues so as to add salespeople and software program engineers regardless of the softer macroeconomic backdrop, whereas different know-how firms are freezing hiring or decreasing employees to chop prices, like Meta Platforms (META) and Microsoft (MSFT) have completed just lately.

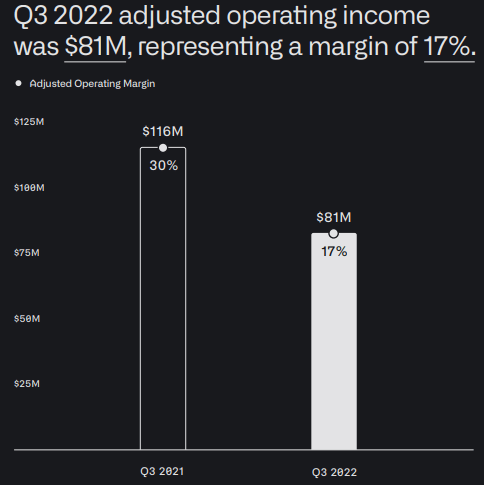

In the course of the quarter, Palantir elevated its headcount by 450 folks, its largest quarterly hiring throughout the 12 months, which was the key driver of upper working bills, which elevated by 9% quarter-on-quarter to $397 million excluding stock-based compensation. As a result of this technique, its adjusted working revenue was $81 million in Q3, a decline in comparison with the identical quarter of final 12 months, and its working margin declined to 17% (vs. 30% in Q3 2021).

Working revenue (Palantir)

Its adjusted free money circulate amounted to $37 million in Q3, marking the eighth consecutive quarter of constructive free money circulate technology, whereas within the first 9 months of 2022, its adjusted free money circulate was $231 million. On the finish of September, Palantir’s money place was about $2.4 billion and the corporate stays debt free, having due to this fact a really robust steadiness sheet.

Concerning its steerage, the corporate expects Q3 income to be about $504 million, whereas the market was anticipating $503 million, and sees working earnings of $78-$80 million. For the total 12 months, its annual revenues must be about $1.9 billion, representing annual progress of 23.3%.

Which means that Palantir will miss its annual income progress goal of about 30%, because the difficult financial setting and powerful greenback are impacting worldwide income, and U.S. authorities income has elevated at a slower price in current quarters than anticipated.

Regardless of that, Palantir’s medium-term progress technique is just not being scaled down, which clearly reveals that administration has a long-term mentality and is sustaining its marketing strategy to create worth for shareholders over the lengthy haul, regardless of within the brief time period this having a detrimental influence on its working margins and share value.

Valuation

Concerning its valuation, like most progress firms, Palantir’s valuation has de-rated significantly over current months, though its long-term fundamentals haven’t modified that a lot. Whereas income progress and profitability have been softer in current quarters, that is justified by exterior pressures relatively than basic points, thus a rebound in these metrics is probably going when financial circumstances enhance over the subsequent few quarters.

Bearing in mind this background, like many progress firms that aren’t worthwhile proper now and are exhibiting some slowdown of their top-lines, Palantir’s inventory has been punished in current months and is down by some 55% year-to-date.

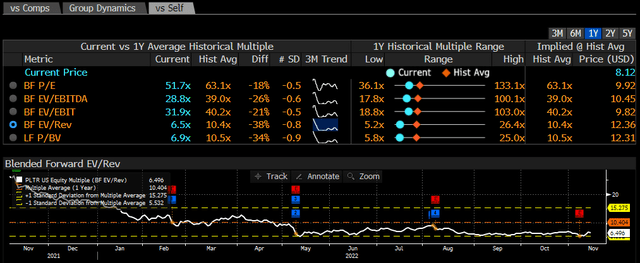

As proven within the subsequent graph, Palantir was valued at greater than 30x ahead revenues on the finish of 2021, however its valuation has dropped significantly prior to now few months, and is buying and selling at some 6.5x ahead revenues these days.

Valuation (Bloomberg)

Subsequently, Palantir’s de-rating has been fairly quick and is buying and selling at a reduction to its historic valuation over the previous 12 months (about 10.4x ahead revenues), and in addition a lot decrease than its historic valuation since its direct itemizing in 2020 (historic valuation of about 18.6x revenues). Which means that its current historic valuation, Palantir’s risk-reward proposition appears good, because the draw back seems to be restricted and upside potential is kind of good.

This view can be confirmed from an absolute valuation strategy, provided that present consensus estimates of 2025 income of round $4 billion, and a valuation a number of of 10.4x (in-line with its current historic common), my value goal for end-2024 is $14 per share, or 76% larger than its present share value. Nevertheless, this valuation could also be a lot too conservative, and the next a number of is probably going if progress improves within the subsequent couple of years, which might result in even larger upside.

Conclusion

Palantir reported an honest Q3 and its steerage was kind of consistent with market expectations, which was not sufficient to spice up its share value, which reacted negatively on earnings day. Nevertheless, extra importantly for long-term traders, in my view, the corporate reported good metrics relating to buyer progress, variety of offers and billings, and elevated the whole remaining deal worth, all constructive indicators for income progress within the subsequent few quarters.

Moreover, Palantir continues to put money into enterprise progress, exhibiting that it is sustaining its long-term strategy, which ought to create worth for shareholders over the lengthy haul. Its shares stay undervalued and Palantir is a purchase following its Q3 earnings report.